Introducing the PaySense Partner App, the ultimate solution for individual and business partners to offer their customers personalized financing options. With this app, you can empower your customers to secure personal loans for a variety of needs, including medical emergencies, education expenses, weddings, and even upgrading their electronics. The best part? No credit card or bureau score is required! PaySense caters to a wide range of customers, including salaried, non-salaried, and self-employed individuals. Offering instant loans ranging from ₹5000 to ₹500,000, with competitive interest rates between 18% to 36% (on a reducing balance basis), this app provides a seamless and affordable solution for borrowers. So why wait? Join the app and help your customers meet their financial goals today!

Features of PaySense Partner:

⭐ Wide Range of Uses:

It caters to diverse financial needs, making it highly versatile and helpful to users. Whether you require funds for medical emergencies, education expenses, marriage costs, purchasing a two-wheeler, school or college fees, electronics upgrades, credit card bills, jewelry purchases, home decor, or any other personal requirement, this app has got you covered.

⭐ Inclusive Eligibility:

Unlike traditional loan services, PaySense believes in inclusivity. They serve customers from various employment backgrounds, including salaried, non-salaried, and self-employed individuals. The app treats each applicant fairly, efficiently assessing their financial stability and requirements, ensuring optimized loan acceptance rates.

⭐ Rapid Loan Approval:

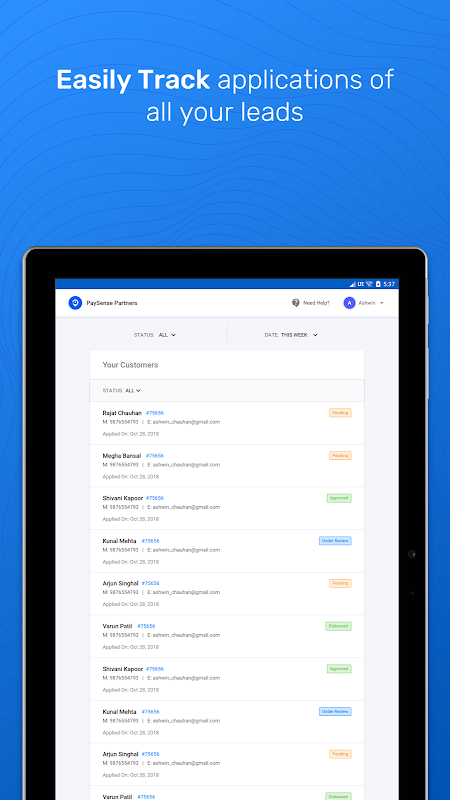

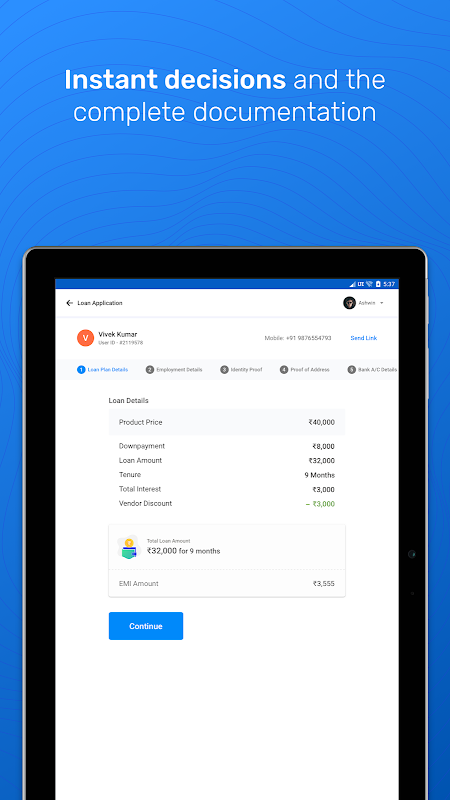

Need money urgently? PaySense Partner offers instant loan approvals, significantly reducing waiting times. Upon submission of your loan application, you'll receive a quick response, enabling you to promptly tackle your financial needs. Say goodbye to lengthy and complex loan processes with this user-friendly app.

⭐ Flexible Repayment Options:

To provide convenience and ease to borrowers, PaySense offers extended repayment durations ranging from 3 to 60 months. This allows users to select the repayment tenure that suits their financial situation best. The flexibility ensures that you can manage your loan installments comfortably and effectively.

Tips for Users:

⭐ Complete Profile:

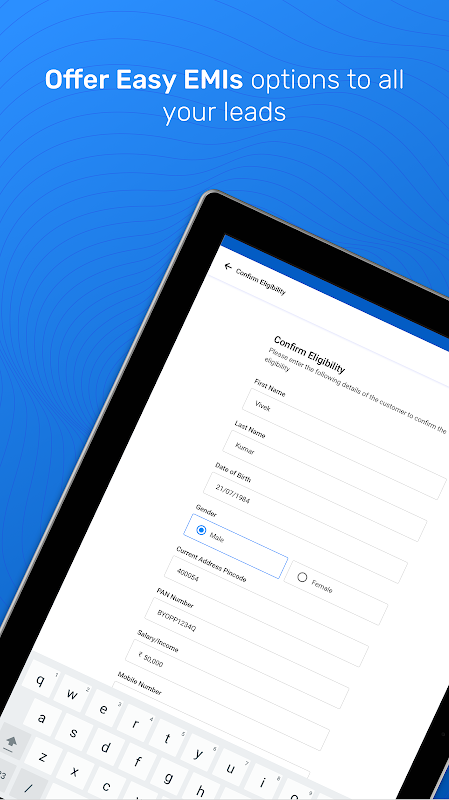

To maximize your chances of loan approval, ensure that you fill out your profile accurately and comprehensively. Provide all necessary information, including personal details, employment history, and income sources. A complete profile assists PaySense in assessing your eligibility promptly.

⭐ Proper Documentation:

PaySense Partner requires users to submit essential documents to verify their identity, address, income, and employment details. Ensure that you upload clear and valid documents to expedite the verification process, ensuring a smooth loan approval experience.

⭐ Be Realistic with Loan Amounts:

Before submitting your loan application, carefully consider your financial requirements. Apply for a loan amount that aligns with your repayment capacity, ensuring that you can comfortably meet the monthly installments. Responsible borrowing will help build your credit score and establish a trustworthy relationship with PaySense.

Conclusion:

With its wide range of uses, inclusive eligibility criteria, rapid loan approval, and flexible repayment options, this app has revolutionized the lending industry. By completing your profile accurately, providing proper documentation, and being mindful of your borrowing capacity, you can maximize the benefits offered by PaySense. Experience the ease and efficiency of financial assistance at your fingertips. Download the PaySense Partner today and empower yourself financially.